-

Learn about the basics of school finance, including how public school districts are funded, where the money goes, definitions of key concepts, and more.

-

REVENUE

Public schools in the state of Texas are funded from three main sources: local school district property taxes, state funds, and federal funds, with the majority of funding coming from local property taxes collected by school districts and state funds.

The Basic Allotment is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on their Average Daily Attendance. The Basic Allotment is currently set at $6,160 per student (2024), with additional funding based on district and student characteristics. The district’s Tier 1 Entitlement is determined by the Basic Allotment and the characteristics of students in the district.

This video shares LISD's scenario during the spring of 2023.

The Tier 1 Entitlement is covered by state and local funds. Local tax collections are applied to determine whether or not the state contributes additional funds, and then the state covers a specific portion from the Foundation School Program portion of the state’s budget. Tier One of the Foundation School Program is made up of several allotments, including those for regular basic education, special education, dyslexia, compensatory education, bilingual education, career and technology education, early education, college, career, or military readiness, teacher incentives, transportation, and new instructional facilities.

-

Example 1: If the district’s local tax collections cover the Tier 1 Entitlement, then only Foundation School Program funds are distributed.

-

Example 2: If the district’s local tax collections do not fully cover the Tier 1 Entitlement, state funds are received to make up the difference in addition to the Foundation School Program funds.

-

Example 3: If the district’s local tax collections exceed the Tier 1 Entitlement to the extent that no additional state aid (above Foundation School Program) is needed to cover the total cost, then the district is required to send the tax collections exceeding the Tier 1 Entitlement back to the state through the mechanism known as Recapture.

-

-

Local

Local tax dollars make up the majority of the district’s revenue sources. The school district’s board of trustees sets the local property tax rate each year while the county appraisal district determines the market value of property within the county or district.In an area like Lewisville ISD where home values have rapidly increased, even when the tax rate stays the same or is lowered, homeowners will likely see an increase in the total amount of taxes owed due to the higher property values.

State

The amount of state revenue earned each year is determined by the Tier 1 Entitlement calculation and in Tier 2 by the guaranteed yields on the golden and copper penny portions of the tax rate.When local property tax collections do not fully fund the Tier 1 entitlement, state revenues are earned. When local property tax collections result in more revenues than are necessary to cover the Tier 1 Entitlement, the district sends those excess tax collections to the state through a mechanism called recapture.

In Tier 2, if the golden pennies and copper pennies do not produce the required revenue per student, then additional state revenues are earned. There is no recapture on the tax collections generated by the golden penny portion of the tax rate; however, the copper penny revenue is subject to recapture.

As local tax collections increase, state funds to a school district decrease.

Federal

Federal funding for Texas school districts varies from district to district based on various federal grants and formulas. For the operations of Lewisville ISD, federal funds in the General Fund equate to about 3% of total revenues and are mostly generated from indirect costs charged to the federal grants and programs related to special education services.Most federal revenues received by a school district are accounted for in Special Revenue Fund groups and not the General Fund.

Revenue Per Student

A high-quality and well-funded public education system is essential to help every child to reach their full potential. Texas ranks in the bottom 10 states in per-student funding and is currently (2024) $4,000 behind the national average in per-pupil spending. Additionally, the Basic Allotment has not increased since 2019 amid soaring inflation rates. With double-digit inflation, this means our education dollars do not go as far as they used to.An increase to the basic allotment will allow Texas school districts to maintain their facilities, invest in innovation, and provide raises for teachers and staff every year. The $19 billion Texas public schools received in federal stimulus funds expire in 2024, and our current school finance formulas are not flexible enough to meet the ongoing instructional demands or inflationary cost pressures.

Is it true public education funding is actually between $12,000-$14,000 per student?

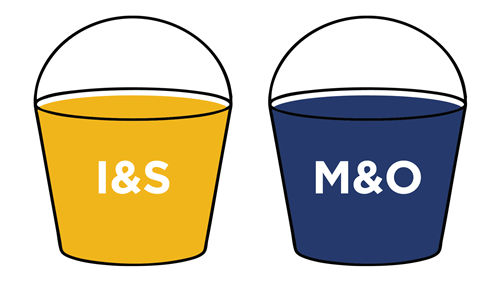

These figures are not an accurate representation of what a district has available to spend on daily operations through M&O funds. They include bond funds (I&S funds that cannot be used on salaries) and retirement funds (TRS on-behalf). Additionally, this figure includes money that is generated from a VATRE, which not every district has, and those are funds voted on by local communities. Finally, these figures also include COVID relief funds (ESSER) that districts no longer have access to.

-

TAX RATE

TAX RATESchool budgets and tax rates are split into two different revenue streams funded by taxpayer dollars, which we’ll represent with a blue and yellow bucket. The money generated from each part can only be used for specific types of expenses.

The Maintenance and Operations budget, or M&O, and the Interest & Sinking budget, or I&S.

-

This video shares LISD's scenario during the spring of 2024. LISD held a bond election that included three propositions during this time, which were all approved by voters.

-

Maintenance & Operations (M&O)

Funding coming into this bucket is primarily used for operating the district. Employee salaries and benefits; student educational resources; classroom supplies and equipment; and contracted services – like utilities, insurance, transportation, legal and audit services, etc. – are paid from this source of funding.To relate this to an average community member, this is similar to things like car fuel and routine maintenance, groceries, clothing, cleaning supplies, and utilities like electricity and water.

The M&O funding source is split into two tiers: Tier 1 and Tier 2.

Tier 1

The Tier 1 Entitlement is based on the Basic Allotment (BA), as set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). The BA is currently set at $6,160 per student, with additional funding depending on district and student characteristics such as transportation miles/costs and fast growth.Tier 2

Funds that enrich the educational offerings a school district provides students – on top of the BA, currently set to $6,160 – fall into M&O Tier 2. Examples of these enrichments include small class sizes and specialized programs or courses that go beyond those required in the Texas Essential Knowledge Skills (TEKS). Funding in Tier 2 comes in two forms: Golden Pennies and Copper Pennies.Golden Pennies

Golden Pennies are a portion of the M&O tax rate that bring in revenue above the Tier 1 Entitlement and are not subject to Recapture, meaning 100 percent of the revenue generated from this part of the M&O tax rate stays in the district. They are referred to as “golden” because of their high value to a school district and because state aid can be generated to fully fund the calculated entitlement.In 2023, LISD voters approved the addition of three (3) golden pennies to the district’s five (5) in a Voter Approval Tax Rate Ratification Election (VATRE). Therefore, LISD currently uses eight (8) golden pennies as part of its M&O tax rate out of a total of eight (8) allowable golden pennies.

Copper Pennies

Copper Pennies are a portion of the M&O tax rate that brings in revenue above the Tier 1 Entitlement and can generate additional state aid but is subject to Recapture. In 2023, LISD voters approved the addition of five (5) Copper Pennies to the district’s M&O tax rate in a Voter Approval Tax Rate Ratification Election (VATRE). LISD currently uses five (5) Copper Pennies as part of its M&O tax rate out of a total of nine (9) allowable Copper Pennies.

-

Interest & Sinking (I&S)

The yellow bucket represents funds that are used to pay off bond debt that has been approved by voters through the Interest and Sinking, or I&S, portion of the tax rate. A school district’s I&S tax rate is set by local school boards, and is determined by how much revenue is required to pay off bond debt.The yellow bucket of funds can only be used to pay debt to support major facilities repair and renovation, and construction projects that are proposed in bond elections. Every facility we have in LISD was built with bond funds - every school building, stadium, competition field, and more. Funds in the yellow bucket are not subject to recapture, which means 100% of funds from the I&S side of the tax rate stay in the district.

This video shares LISD's scenario during the spring of 2024. LISD held a bond election that included three propositions during this time, which were all approved by voters.

The only way to fund the construction of new campuses is for the district to issue debt or use General Fund fund balance. Using only the General Fund to build campuses is not an option, however, because of the sizable cost to build new schools; therefore, the district has issued bonds to finance facilities. Bond debt is paid down through funds collected from the I&S tax rate.

-

RECAPTURE

Recapture is the state’s mechanism for making sure that a district with high property values does not have more funding than a neighboring district with lower property values. The state provides more funding to school districts with lower local property tax revenues; less state funding to districts with a strong source of local property tax revenues; and requires districts with the highest local property wealth per student to give some of their local tax revenue back to the state. This latter option is referred to as Recapture payments, also known as Robin Hood payments.

The money sent back to the state through recapture comes from money generated from the M&O portion of the tax rate (the blue bucket) that generates more revenue than needed to fund the Tier 1 Entitlement or excess revenues generated on Copper Pennies above the yield.

The intent of recapture is to redistribute funds from districts that exceed their entitlement to districts that do not meet their entitlement. Instead, the recapture funds fall into the state’s general budget, with no transparency on how or where it is being used. The best way to relieve the burden on school districts related to Recapture is to increase the Basic Allotment, which benefits all school districts in the state.

This video shares LISD's scenario during the spring of 2023.

-

EXPENDITURES

In LISD, payroll costs make up 85% percent of the operating budget (funds accessed by the blue bucket, or the M&O portion of the tax rate), which include paying teachers, librarians, instructional aides, bus drivers, custodians, principals, administrators and all of the more than 6,000 employees of the district. Other expenditures include utilities, contracted services, student educational resources, classroom supplies and equipment, travel and legal and audit services.

-

GLOSSARY OF TERMS

Basic Allotment

The Basic Allotment is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA).

Average Daily Attendance (ADA)

Average Daily Attendance (ADA) is the number of students in average daily attendance or the sum of attendance for each day of the minimum number of days of instruction.

Weighted Average Daily Attendance (WADA)

Weighted Average Daily Attendance (WADA) is an adjusted student count taking into account student and district characteristics by which students in certain programs are “weighted” to generate additional funds.

Maintenance and Operations Tax Rate (M&O)

Dollars from this portion of the rate are used toward expenses like payroll, utilities, supplies and transportation.

Interest and Sinking or Debt Service Tax Rate (I&S)

Dollars from this portion of the rate can only be used to pay down existing debt. These tax collections cannot be used for operations, such as increasing teacher salaries or to build facilities.

Recapture

Recapture is the state’s mechanism for making sure that a district with high property values does not have more funding than a neighboring district with lower property values. The intent of recapture is to redistribute funds from districts that exceed their entitlement to districts that do not meet their entitlement. Instead, the recapture funds fall into the state’s general budget, with no transparency on how or where it is being used.

Golden Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and is not subject to Recapture, meaning 100 percent of the revenue generated from this part of the tax rate stays in the district.

Copper Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and can generate additional state aid but is subject to Recapture.

Fund Balance

A fund balance is like a savings account or emergency account that includes money that school districts do not allocate in budgets and hold in reserve. Fund balance is generated when annual revenues exceed actual operating costs. These funds are used to manage fluctuations in cash flow and to cover unforeseen expenses.

Voter Approval Tax Rate Ratification Election (VATRE)

If the board adopts a tax rate that’s greater than the calculated rate set by law, that triggers an election called a Voter-Approval Tax Rate Election, which is held on a uniform election date (November).